- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Flash version

© UniFlip.com

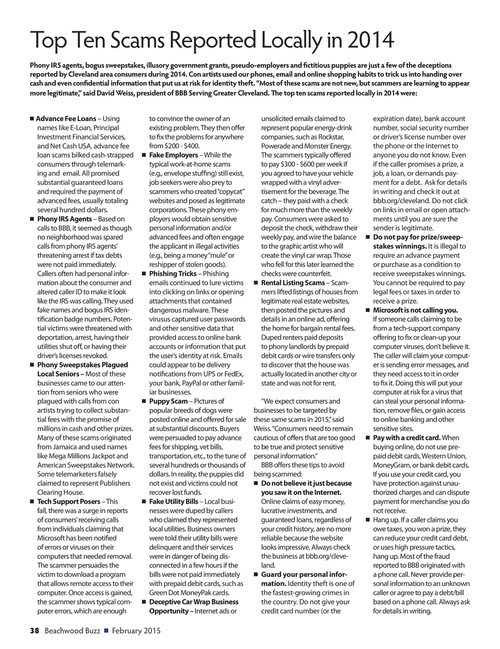

Top Ten Scams Reported Locally in 2014

Phony IRS agents, bogus sweepstakes, illusory government grants, pseudo-employers and fictitious puppies are just a few of the deceptions reported by Cleveland area consumers during 2014. Con artists used our phones, email and online shopping habits to trick us into handing over cash and even confidential information that put us at risk for identity theft. “Most of these scams are not new, but scammers are learning to appear more legitimate,” said David Weiss, president of BBB Serving Greater Cleveland. The top ten scams reported locally in 2014 were: n Advance Fee Loans – Using names like E-Loan, Principal Investment Financial Services, and Net Cash USA, advance fee loan scams bilked cash-strapped consumers through telemarking and email. All promised substantial guaranteed loans and required the payment of advanced fees, usually totaling several hundred dollars. n Phony IRS Agents – Based on calls to BBB, it seemed as though no neighborhood was spared calls from phony IRS agents’ threatening arrest if tax debts were not paid immediately. Callers often had personal information about the consumer and altered caller ID to make it look like the IRS was calling. They used fake names and bogus IRS identification badge numbers. Potential victims were threatened with deportation, arrest, having their utilities shut off, or having their driver’s licenses revoked. n Phony Sweepstakes Plagued Local Seniors – Most of these businesses came to our attention from seniors who were plagued with calls from con artists trying to collect substantial fees with the promise of millions in cash and other prizes. Many of these scams originated from Jamaica and used names like Mega Millions Jackpot and American Sweepstakes Network. Some telemarketers falsely claimed to represent Publishers Clearing House. n Tech Support Posers – This fall, there was a surge in reports of consumers’ receiving calls from individuals claiming that Microsoft has been notified of errors or viruses on their computers that needed removal. The scammer persuades the victim to download a program that allows remote access to their computer. Once access is gained, the scammer shows typical computer errors, which are enough to convince the owner of an existing problem. They then offer to fix the problems for anywhere from $200 - $400. Fake Employers – While the typical work-at-home scams (e.g., envelope stuffing) still exist, job seekers were also prey to scammers who created “copycat” websites and posed as legitimate corporations. These phony employers would obtain sensitive personal information and/or advanced fees and often engage the applicant in illegal activities (e.g., being a money “mule” or reshipper of stolen goods). Phishing Tricks – Phishing emails continued to lure victims into clicking on links or opening attachments that contained dangerous malware. These virusus captured user passwords and other sensitive data that provided access to online bank accounts or information that put the user’s identity at risk. Emails could appear to be delivery notifications from UPS or FedEx, your bank, PayPal or other familiar businesses. Puppy Scam – Pictures of popular breeds of dogs were posted online and offered for sale at substantial discounts. Buyers were persuaded to pay advance fees for shipping, vet bills, transportation, etc., to the tune of several hundreds or thousands of dollars. In reality, the puppies did not exist and victims could not recover lost funds. Fake Utility Bills – Local businesses were duped by callers who claimed they represented local utilities. Business owners were told their utility bills were delinquent and their services were in danger of being disconnected in a few hours if the bills were not paid immediately with prepaid debit cards, such as Green Dot MoneyPak cards. Deceptive Car Wrap Business Opportunity – Internet ads or unsolicited emails claimed to represent popular energy-drink companies, such as Rockstar, Powerade and Monster Energy. The scammers typically offered to pay $300 - $600 per week if you agreed to have your vehicle wrapped with a vinyl advertisement for the beverage. The catch – they paid with a check for much more than the weekly pay. Consumers were asked to deposit the check, withdraw their weekly pay, and wire the balance to the graphic artist who will create the vinyl car wrap. Those who fell for this later learned the checks were counterfeit. n Rental Listing Scams – Scammers lifted listings of houses from legitimate real estate websites, then posted the pictures and details in an online ad, offering the home for bargain rental fees. Duped renters paid deposits to phony landlords by prepaid debit cards or wire transfers only to discover that the house was actually located in another city or state and was not for rent. “We expect consumers and businesses to be targeted by these same scams in 2015,” said Weiss. “Consumers need to remain cautious of offers that are too good to be true and protect sensitive personal information.” BBB offers these tips to avoid being scammed: n Do not believe it just because you saw it on the Internet. Online claims of easy money, lucrative investments, and guaranteed loans, regardless of your credit history, are no more reliable because the website looks impressive. Always check the business at bbb.org/cleveland. n Guard your personal information. Identity theft is one of the fastest-growing crimes in the country. Do not give your credit card number (or the expiration date), bank account number, social security number or driver’s license number over the phone or the Internet to anyone you do not know. Even if the caller promises a prize, a job, a loan, or demands payment for a debt. Ask for details in writing and check it out at bbb.org/cleveland. Do not click on links in email or open attachments until you are sure the sender is legitimate. Do not pay for prize/sweepstakes winnings. It is illegal to require an advance payment or purchase as a condition to receive sweepstakes winnings. You cannot be required to pay legal fees or taxes in order to receive a prize. Microsoft is not calling you. If someone calls claiming to be from a tech-support company offering to fix or clean-up your computer viruses, don’t believe it. The caller will claim your computer is sending error messages, and they need access to it in order to fix it. Doing this will put your computer at risk for a virus that can steal your personal information, remove files, or gain access to online banking and other sensitive sites. Pay with a credit card. When buying online, do not use prepaid debit cards, Western Union, MoneyGram, or bank debit cards. If you use your credit card, you have protection against unauthorized charges and can dispute payment for merchandise you do not receive. Hang up. If a caller claims you owe taxes, you won a prize, they can reduce your credit card debt, or uses high pressure tactics, hang up. Most of the fraud reported to BBB originated with a phone call. Never provide personal information to an unknown caller or agree to pay a debt/bill based on a phone call. Always ask for details in writing.

n

n

n

n

n

n

n

n

n

38 Beachwood Buzz n February 2015